Explaining the Voluntary Carbon Market

The voluntary carbon market (VCM) is a set of fragmented markets where private corporations, individuals and other actors issue, buy and sell carbon credits. It serves as a platform for trading carbon credits outside of regulated or mandatory carbon pricing instruments. Participants in the VCM, including companies, non-governmental organisations and various stakeholders, use it to finance activities aimed at mitigating greenhouse gas (GHG) emissions across sectors such as industry, transportation, energy, built environment, agriculture, forestry, and more. While governments can regulate VCM activities within their territory, carbon crediting programmes establish rules for carbon credit generation.

This page offers information and assistance to navigate the market environment effectively, including approaches that governments can take for regulating the VCM.

You can also click here to find more background information on the VCM Primer.

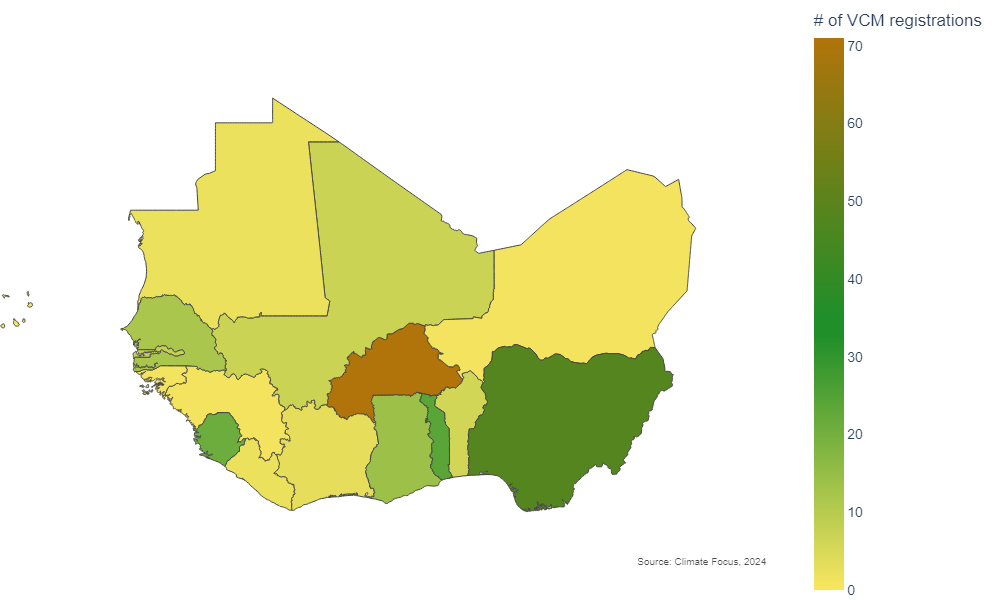

What is the status and the role of the VCM in West Africa?

West African nations are currently hosting a variety of VCM activities and initiatives, numbering in the hundreds. Participating in this market segement offers both opportunities and challenges for governments in developing countries. This informational note offers a high-level overview of the ongoing activities and crediting programmes present in the region, highlighting the crucial role of robust implementation and standards in promoting sustainable development and nurturing a green economy.

For further information on VCM activities in individual West African countries, please visit our Member Country page.

Download information note on VCM activities in West Africa

Technical report: Stakeholders’ Perspectives on Carbon and Climate Finance in West Africa (WAA & CF 2022)

For up-to-date information on global carbon markets, you can consult the Voluntary Carbon Market Dashboard

What is the role of carbon crediting programmes in the VCM?

Carbon crediting programmes are developed and administered by private organisations — typically international non-governmental organisations (NGOs). GHG crediting programmes – also called carbon standards – establish a set of rules, procedures and methodologies that are requirements for certified carbon credits generated through carbon market projects and activities. Organisations administering these standards play a crucial role in safeguarding the quality of VCM carbon credits and providing credibility to the baseline and credit system on which the VCM relies.

Download Information Note on Carbon Crediting ProgrammesBased on revised 2025 estimates of voluntary carbon market (VCM) shares, the carbon crediting programmes contributing the largest volumes of credits to the VCM are:

- VERRA (formerly the Verified Carbon Standard) ~35 %

- Gold Standard (GS) ~27 %

- American Carbon Registry (ACR) ~17 %

- Other registries combined (including Climate Action Reserve (CAR), BioCarbon Standard, Puro.earth, and smaller programmes) ~21 %+

VCM Primer : What is the role of carbon standards in the voluntary carbon market? (CF 2023)

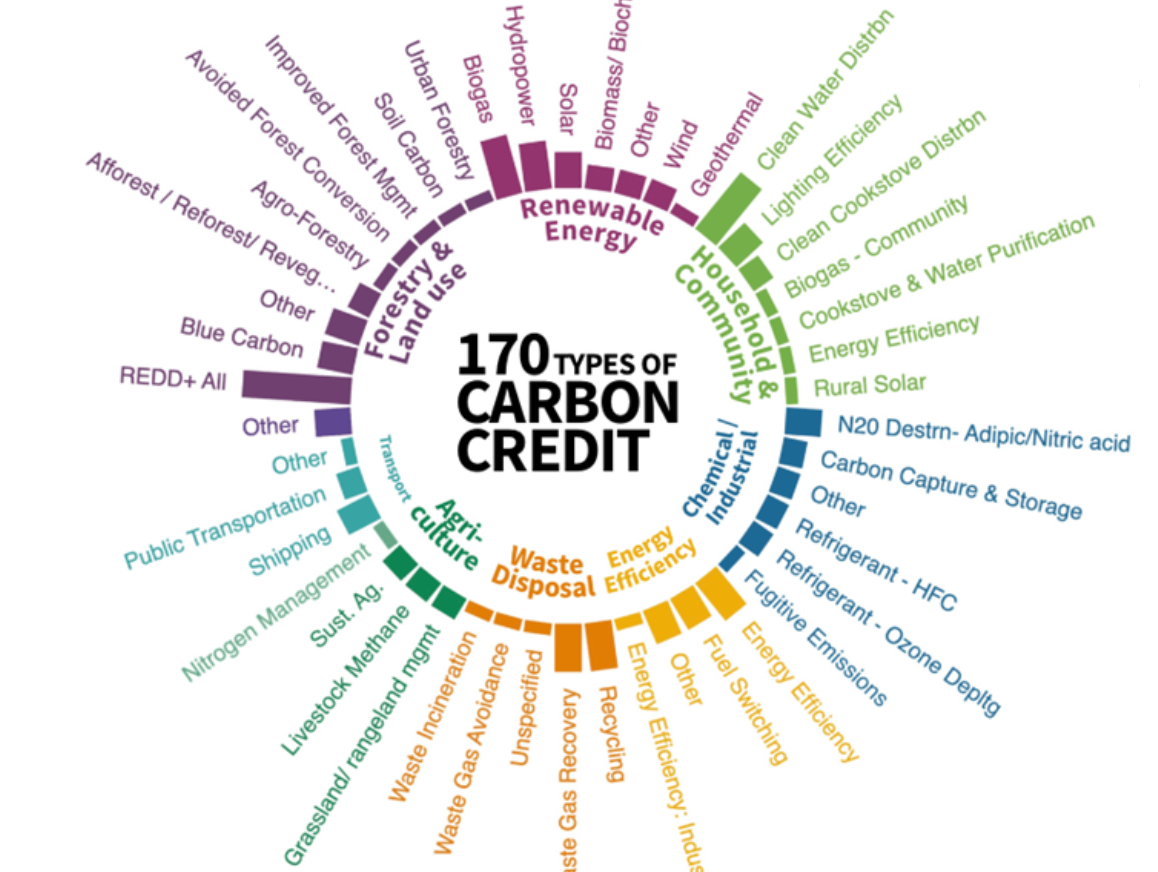

What types of credits are there?

A carbon credit is a transferable unit representing the reduction or removal of one ton of greenhouse gas (GHG) emissions. Within the VCM, these credits are generated through various activities, such as projects and programmes certified by independent crediting programmes.

The valuation of carbon credits is an intricate process influenced by multiple factors, each playing a crucial role in shaping market dynamics. Carbon credit prices are determined by various aspects of the market segment’s structure, including project size and location, vintage, quality, co-benefits, certifications, negotiation power and risk. These variables collectively contribute to the intricacies of the VCM, reflecting the diverse nature of environmental initiatives and offseting strategies.

Image source: Ecosystem Marketplace (2022)

Download Information Note on Types of Credits

REDD+ credit type, frequently traded and generated under the voluntary carbon market (VCM) segment, represent a unique case. There is potential to include them under Article 6.2, which may be particularly relevant for countries with abundant forest cover, offering an additional financing option when determining which activities to include under cooperative approaches. Moreover, the Paris Agreement Crediting Mechanism (PACM) is advancing in establishing more robust standards for carbon removals, affecting those generated through REDD+ activities. Due to the contentious nature of REDD+ projects and their unique status under Article 6, it is important to gather in-depth insights and consider special requirements for this category of VCM projects. You can learn more about these developments in this information note.

Download Information Note on REDD+ CreditsVCM Primer: What are carbon credits?(CF 2023)

VCM Primer: How is the VCM structured? (CF 2023)

VCM Primer: How are carbon credits used? (CF 2023)

VCM Primer: How can the VCM support REDD+? (CF 2023)

Explainer: REDD+ and Article 6: COP29 and Beyond (Nature Concervancy & Conservation International 2024)

Guidelines: Guidelines for high-integrity use of carbon credits (IETA 2024)

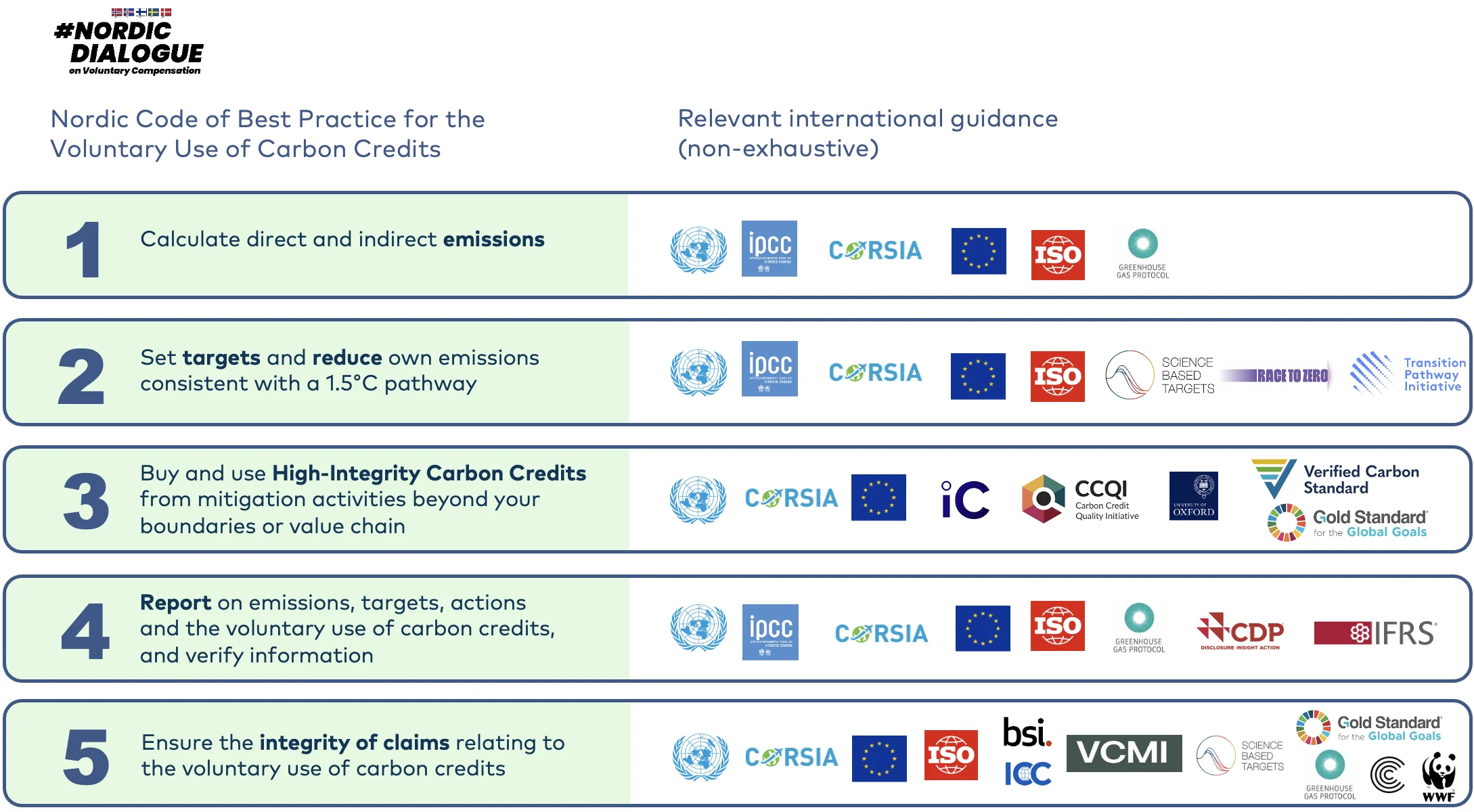

How do claims, good practice principles and use cases come into play?

Companies often utilise carbon credits purchased from the VCM to substantiate climate-related claims associated with their entities, products, and services. Nevertheless, there has been significant uncertainty surrounding the generation of these credits and the assertions tied to them. Various organisations and governmental bodies, in consultation with stakeholder groups, are developing guidance on best practices to address this issue. This collaborative effort aims to offer greater clarity on the matter, recognising both the reputational risks involved and the need to strengthen the effectiveness of voluntary carbon markets in addressing climate challenges. The following information note showcases that credible claims should be based on mitigation outcomes meeting internationally established criteria and outlines action to pursue this objective effectively.

Image Source: Nordic Dialogue (2024)

Download Information Note on Types of Claims and Good Practice Principles

As the VCM increasingly interacts with Article 6, the distinction between compliance and voluntary carbon markets becomes less clear. This evolving dynamic enables carbon credits to be contemplated for diverse applications or use cases.

Learn more about credit use casesWhat are integrity initiatives trying to achieve?

In response to the uncertainty and scandals that have become commonplace in the VCM, several international initiatives have emerged in recent years with the aim of enhancing the integrity and credibility of this market segment. These initiatives advocate for transparent and scientifically-aligned practices to advance meaningful climate action and build confidence in the VCM. The following information note provides an overview of diverse rulebooks, codes of practice, benchmarks and governance mechanisms developed by entities and groups of stakeholders in order to establish a more transparent and accountable VCM ecosystem to help ensure that this market segment serves as a credible and effective instrument in the fight against climate change.

Image source: ICVCM and VCMI (2023)

Download Information Note on VCM Integrity Initiatives

VCMI (2023): Claims Code of Practice

VCMI (2023): Supplementary guidance Guidance on communicating climate claims

VCMI (2021): VCM Related Claims Categorization, Utilization, & Transparency Criteria

ICVCM: 10 Core Carbon Principles

ICVCM: Assessment Framework

How can governments regulate the VCM?

Governments can engage with carbon markets in a variety of ways for example as regulators, activity proponents, or facilitators. Their responsibilities include designing appropriate regulations that ensure that voluntary carbon projects align with national strategies and adhere to environmental and social safeguards. Moreover, public agencies can directly implement or finance programmes and activities to create incentives that attract carbon investments for priority sectors.

Download Information Note on Regulating the VCM

Guidance: Country Guidance for Navigating Carbon Markets (WB, VCMI 2025)

Policy paper: Host Country Perspective Addressing risks and securing benefits of engaging on the voluntary carbon market (Wuppertal Institute 2024)

VCM Primer: What is the role of governments in the VCM? (CF 2023)